DEP – Deposits / Cashless library

1 Introduction

In general, this functionality requires the library to define one of more types of deposits that may be used by borrowers of the library. Within a type of deposit, the library then defines which types of charges the deposit can pay for (i.e. only loan fees). Additional parameters can then be defined for each deposit type at the borrower category level for min/max levels for deposit amounts, etc. A borrower can then add money to his/her deposits. Payments which were traditionally done through an exchange of cash may then be replaced by paying outstanding amounts owing out of the money a borrower already has on deposit with the library.

1.1 Creation of a deposit

Libraries have the ability to create a deposit. The registration of this deposit can be done through the following workflows:

· a “modify deposit” feature in the borrower administration (AFO 431);

· a “modify deposit” feature in AFO 417 (Refunds and miscellaneous payments);

· self-service pay stations;

· in loans and returns [this links directly to the Deposits feature, and is different from the general link to AFO 414];

Parameters include:

· minimum amount of positive deposit change [you put an additional amount of money into your account. This parameter is available to define that e.g. a minimum of 1 euro should be deposited]

· maximum amount of negative deposit change [you withdraw money from your account. This parameter is available to restrict the amount that you can withdraw at any one time]

· maximum total amount of deposit

· minimum total amount of deposit (positive or negative)

· warning amount (see below)

· block amount (if your account is below this amount, you are blocked until your deposit rises again above the block amount. You are, however, still allowed to Return books and Pay outstanding debts. You are also blocked from WebOpac usage]

These parameters are defined for each individual deposit used by the library (see next section).

If the library wants to allow it, the deposit can be negative (i.e. you can be in debt to the library, i.e. the deposit can turn from credit to debit, if the library-defined rules allow it).

1.2 Deployment / usage of the deposits

The library has the ability to create multiple deposits. The usage of each deposit can be restricted to certain payment types (e.g. deposit one is used for sales of articles, the other deposit for all other transactions).

Parameters include:

· the ability to create one or more deposits

· definition of which deposits can be used for which payment types (payment types here refer to the traditional types within the application, such as loan fees, fines, membership, enrolment fees, etc.)

[The simplest implementation is: one deposit for all payment types.]

Although it is technically possible to create multiple deposits, it is assumed that most systems only use one such deposit.

[All parameters as described above are defined per deposit. This also implies, for example, that blocks are on the individual deposit level.]

Note

There are no mechanisms to transfer money from one deposit to another.

2 Payments and refunds

2.1 Payments using a deposit

The system displays whether or not there is still money available in each deposit in a bordered window at the top of the screen.

Payments from deposit are possible as follows:

· There are two options on the payment screen (AFO 414, and of course all AFO's that invoke the payment screen, such as e.g. AFO 411 and 412) that imply payment by deposit.

· Deposit payments are listed under the available payment types (e.g. cash, bank, giro, deposit 1, deposit 2, etc.) in AFO 414.

· Cash payments are allowed even if there is a positive (deposit) balance. This implies the following:

- [a] the system pays from deposit; and

- [b] the system automatically adds any remaining money to your account.

What this basically means is the following. If you have to pay 4.00, your account balance is at 10.00 and you want to pay the 4.00 in cash, the system processes this transaction as follows: [1] a registration of a payment from deposit for 4.00, the deposit is now at 6.00; and [2] a deposit of an additional 4.00 to the deposit, which is then back at 10.00.

2.2 Pay back (refund) a deposit

The system has the ability to pay back (refund) money from deposits. This is done through AFO 431 or AFO 417.

Parameters include:

· the ability to restrict the usage of this option to certain (staff) users

· minimum amount that will be refunded (cash / pay back)

· administrative cost for refund (cash / pay back)

· whether or not partial refunds are allowed (yes/no)

Paying back deposits can be done by:

· cash refunds

3 Impact

This section describes the impact of using deposits on various aspects of the system.

3.1 Reporting and messages

a. Detailed current balance overviews:

The system displays the detailed current balance of deposits as follows:

· In the WebOpac, you can view your current balance and the related transaction history, backdated to a library-defined period (technical maximum will be January 1 of the previous calendar year).

- In borrower administration, the payment history displays which payments are made from a deposit.

- You have the ability to print your current balance and history via the WebOpac, or, at request, via staff users (AFO 431). There are two display print formats: a detailed and a summary overview.

b. Summary balance messages:

The system displays a summary balance in the following cases:

· In the circulation activities that display summary information for a borrower in a so-called bordered window, the system shows the balance for each deposit.

· The current balance of each deposit is printed on print slips (such as loans, returns, and others).

· Payment print slips show the balance before and after the current transaction.

c. Warning messages

· Warning messages are included on print slips and in WebOpac.

d. SSP

· SSP gives access to the current balance and description of each deposit as a selection, sort and print criteria.

e. Storage of approvals / acknowledgements

· automatic invoicing for deposits has been added to the Bank group

· usage of loan history for mailings has been added to the Preferences group

These settings can also be set through the WebOpac, using a secure connection.

f. Business rules

For automatic invoicing (direct debit), a flexible set of business rules has been created that defines when (and how) acceptgiros and automatic invoicing should be done. The business rules consist of the following business rules variables:

· amount

· period (deposit < 0 longer than this number of days)

Examples of business rules are e.g. invoice automatically IF

[a] the deposit balance < -5

OR

[b] the deposit balance is < 0 AND the deposit balance is < 0 for a period longer than 21 days

g. Invoicing to borrowers

The system can automatically produce acceptgiros or automatic invoices (direct debit) if your deposit balance goes below a certain amount or if the deposit balance is open longer than a specific number of days. Four new jobs were added to AFO 451/2/3 to accomplish this:

3.2 Miscellaneous

Loans and renewals:

You are not allowed to borrow or renew items if the balance in your account that pays for loan fees is less than n.

As items are scanned for loan or renewal, the system calculates deductions to the deposit balance based on the loan/renewal fee. When the calculated balance drops below the warning amount (defined for the deposit), a warning is printed to the screen. You are not allowed to scan more items once the deposit balance has dropped below the block amount.

When a borrower is identified in Loans or Returns, the system checks if any of the deposits already held by the borrower are no longer valid. If any of the deposits are no longer supported by the borrower's borrower category, the system displays a warning message that a deposit still exists.

Self-service functionality:

· Self-service loans print slips display the actual deposit balance (and, if applicable, warning messages related to the deposit)..

· No cash money can be withdrawn from the deposit..

All communication is done through the SIP2 protocol.

Cash overviews (AFO's 491/492/493):

The cash payment type overviews include options that distinguish between “cash” and “deposit” type of payments. The system makes a distinction between the following two types of reports:

1. cash payments; this report contains:

· “real” cash payments

· payments that increase deposits

2. payments from deposits; this report contains:

· payments from deposits

Furthermore, cash management provides a menu option called “Current deposits”. This option shows overviews of the outstanding deposits.

Update cash overviews option:

The option Current deposits in AFO 493 – Update cash overview displays a form that allows you to run a job to calculate the current deposit balances. Once this job has been run, you are able to get deposit balance information out of AFO 492.

AFO 492 – Deposit options

In AFO 492 – Cash overviews, there are three options: Deposit overview, Deposit refunds and Payments from deposit.

· Select the Deposit overview option to get a listing of deposit balances.

· Select the Deposit refund option to get a listing of deposit refunds.

· Select the Payments from deposit option to get a listing of payments made from deposits.

AFO 491 – Deposit options

There are two options in AFO 491, Deposit payment and Deposit refund. These options sum up the cash amounts paid into deposit and refunded out of deposits.

Printing slips

The current balance of each deposit for a borrower is printed on print slips (such as loans, returns, and others). Each deposit is printed on a separate line and consists of “Deposit – “ deposit description and deposit current balance

Payment print slips show the before and after balance of each deposit for the borrower. Each deposit is printed on a separate line and consists of “Deposit – “ deposit description, before balance “-“ payment amount “=” deposit current balance.

Warning/error messages are also included on print slips.

WebOpac:

The WebOpac checks to make sure that your account is not below the block amount before allowing you to renew items, SDI, reserve items, etc. Even if you are blocked, you are still allowed to view the static elements of his private pages, such as loan history, outstanding amounts, current loans, etc.

There is an option on the user activities page: My Deposits. This only displays if you have deposits. There is a button to access this on the other user details pages.

Selecting this button takes you to the deposit summary page. Here you can see a list of your deposits and their current values.

To see the details of the transactions for a deposit, click the details button next to the deposit balance.

This shows a list of the transactions for the deposit. You can use the drop down box at the top of this page to select another deposit to display.

The current deposit balance is displayed, and if there is a warning, it displays here.

The deposits button on the menu takes you back to the deposit summary page. This button is enabled on the deposits details page, but not on the deposit summary page.

Changing borrower category:

In AFO 431, when a borrower's borrower category is modified, the system checks to see if any of the deposits already held by the borrower are no longer valid. If any of the deposits are no longer supported by the new borrower category combination, a message displays telling the staff member that a deposit still exists.

Deleting a borrower:

If one or more of the borrower's deposits contains more than the administrative charge amount, you cannot delete the borrower. If all of the borrower's deposits contain either a zero balance or a balance less than or equal to the administrative charge, you can delete the borrower.

4 Setup

This section describes the various parameters that need to be set up before the deposit functionality can be used.

The main parameters are in AFO 481 – Deposits. See the help of that AFO for detailed information on these parameters.

4.1 Deposit codes

The library has the ability to create one or more deposits. The library defines which deposits can be used to pay for which payment types (payment types here refer to the traditional types within the application such as loan fees, fines, membership, enrolment fees, etc.). For example, a library might set up a deposit called Fees and restrict it's use to the payment of loan fees and renewals. This means that if you have 5.00 in your Fees deposit account, you can pay for loan fees out of the Fees deposit account but cannot pay for membership fees out of that account.

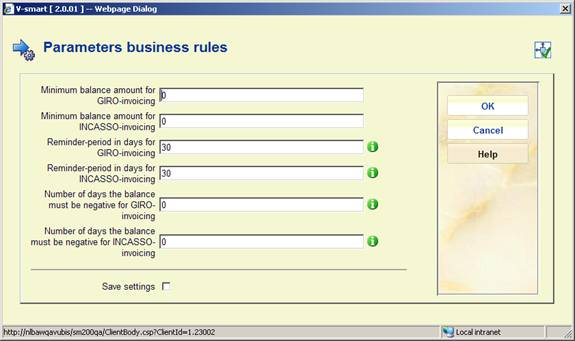

4.2 Business rules

The system can automatically produce acceptgiros or automatic invoices if the deposit balance goes below a certain amount. Business rules are set up at the borrower category level for each location and are used to define when acceptgiros and automatic invoicing (direct debit) takes place.

Comments about these parameters

- Minimum balance amount:

if a deposit drops below this amount it will be invoiced and a giro or an entry in the direct debit-file will be generated for this deposit/borrower.

- Reminder period in days:

if the deposit has been invoiced at date x and is still not paid at date x+this number of days , the borrower will receive a reminder (giro/direct debit). From that moment on the ‘invoice' date will be set to this ‘reminder' date, and if the deposit is still not paid after the number of days from this parameter a new reminder will be generated., and so on.

- Number of days the balance must be negative:

this option can be used to start the invoicing when the balance of the deposit has been negative for a certain period at the moment the invoicing-run is started. This option can be used together with the first one, e.g. to invoice all the deposits that are below -10, regardless how long they are at the current balance, and/or the ones that are negative for at least 14 days.

4.3 Valid payment types for deposits

Payment codes defined in AFO 494 can be selected as valid for adding money to a deposit account.

If NO types are selected, then no special input is required when adding a deposit. If valid types ARE listed, then such a type must be selected when entering the debit amount.

Note:

The parameter is specific to each location (since the payment codes are also location specific).

5 Create / modify a deposit

Once the parameters have been entered, deposits can be created for borrowers. This option is available in AFO's 411, 412, 413, 419, 431 and 464. The icon is greyed out if deposit codes are not defined for your Meta Institution for circulation.

AFO 417 has a menu option for creating / modifying deposits. See the help of this AFO for a full explanation.

In AFO 431 – Details, there is an option to display Deposit history. This option is similar to displaying Payment history. The deposit history option has an extra column, Balance, that displays the current balance in the deposit. There are two print icons on the Deposit history screen - Print summary and Print details.

The Print summary is a one line display per transaction and is the same as the display on the Deposit history screen. The Print details display is similar to the summary display but also includes additional information such as session id, cash register, staff member name. Each line contains: no., date/time, transaction, amount, type, note, session id, cash register, staff member name and balance.

See the help for AFO 431 for more information.

6 Making payments from a deposit

The system displays whether or not there is still money available in each deposit in a bordered window at the top of the screen.

Payments from deposit are possible as follows:

1. Options on the Accept payment screen: Accept total payment from deposit (DP) and Accept total payment from deposit and print receipt (DR). These icons attempt to pay all outstanding charges from the borrower's deposits but must consider which deposits can pay for which types of charges. When making payments, deposits can be debited down to their “minimum total amount of deposit (positive or negative)”. For example, if the scope of your deposit (let's call it XXX) is “PNB/*,TST/*”, the implication is that you can use your XXX deposit to pay at both institutions, no matter where the “debt” for which you are paying was created. If the library wants to avoid this happening, then different deposits for PNB and TST institutions should be created.

If all of the charges cannot be paid by deposit, the system pays what it can out of deposit and leaves the remaining balance to be paid at a later date – the same as partial payment logic works now.

2. Deposit payments are listed under the available payment types (e.g. cash, bank, giro, deposit 1, deposit 2, etc.). The option "Payment from deposit" is shown in the dropdown list if at least one deposit can do (part of) the payment. When you choose the “Payment from deposit” payment type, the system attempts to pay from the borrower's deposits but must consider which deposits can pay for which types of charges.

3.

If you attempt to pay for charges using a payment type other than "from deposit" and you have a deposit with enough money to pay for the charges, the system displays a warning.

If OK, continue with payment. If Cancel, cancel transaction.

7 Sample scenario

Below is a step-by-step guideline for setting up and using deposits. For this example we use a deposit for loan fees at location BD, with certain limits.

7.1 Parameters

AFO 481 – Deposits – Deposit codes:

Define the required deposit code, move payment type Loan fees to the right, determine who can pay money into a deposit. Optionally add relation types if the Payer can be selected from the borrower's linked records.

Next, select the defined code and then the option . Select a borrower categegory on the next screen.

Enter the required amounts and other parameters. Repeat for as many borrower categories as necessary.

AFO 481 – Deposits – Business rules:

These parameters need only be set if you want to produce acceptgiros or direct debiting for deposits that have gone below a certain amount.

Select a borrower category and enter the required treshold amounts.

AFO 481 – Deposits – Valid payment types:

Payment codes defined in AFO 494 (such as Cash, Bank) can be selected as valid for adding money to a deposit account.

If NO types are selected, then no special input is required when adding a deposit. If valid types ARE listed, then such a type must be selected when making a payment (via AFO 414 etc.).

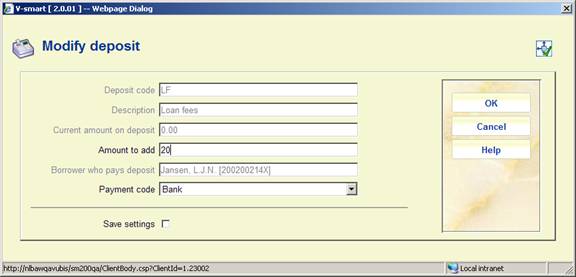

7.2 Creating a deposit

Search for a borrower in AFO 417 and select the option . Select the option from the overview screen:

Select the code you created in AFO 481 from the dropdown list.

On the next screen, add an amount and a payment code (the field Borrower who pays deposit is non-updateable because of the settings in AFO 481), and select a Payment code (as defined in AFO 494) from the dropdown list.

7.3 Payment from a deposit

When a borrower has unpaid loan fees and a deposit, you can pay from deposit in AFO 414 (and any AFO which offers the payment option / 414 screen) by using the option or . If the deposit contains enough money to pay, payment will be effected immediately and the system will leave the payment screen.

If the deposit is insufficient to pay for the fees, a warning will be displayed.

The header of AFO 411 shows information about a borrowers deposit and the amount left in them:

7.4 Payment history

In AFO 431 you can use the option from the borrowers Detail screen. This will show you payments made to incrase the deposit amount (positive) as well as payments made from the deposit (negative):